In a year that will end dramatically different than it began, the US Dollar emerged as a focal point amongst global investors. In the final days of 2009 there is a renewed sense of optimism and hope for continued economic recovery, a far cry from investor's nervousness and skepticism that characterized the beginning of the year. The US Dollar, which had received a safe haven bid during the financial crisis, had now become the funding currency for a new carry trade. The so called risk trade of 2009 or Dollar carry trade featured stronger equity and commodity prices at the expense of the Greenback.

While most of 2008 was marred by risk aversion and volatility, investor's appetite for risk-taking had been restored by early spring 2009. A series of measures by the Obama administration and the Federal Reserve reinstilled confidence into the financial institutions and more importantly the market. Solid first quarter results and guidance by the same financial institutions set the table for the risk trade of 2009 to flourish.

The Fed's outward promise to keep rates low for an extended period of time punished the Greenback, allowing commodities to reflate and equity markets to surge to extraordinary yearly gains. Gold prices lept to fresh record highs by summer's end as the risk trade continued to gain momentum. The Dollar carry eventually climaxed at the end of November with the Japanese Yen reaching a fresh 14-year high against the Greenback.

Risk aversion that stemmed from Dubai World's debt postponement created a massive flight-to-safety into bonds. The sudden drop and subsequent recovery in yields highlighted the end of a shrinking yield differential between the US and Japan. The surge in the Yen was a wake-up call for the BOJ, which consequently expressed concerns of deflation due to currency appreciation. While equity markets have remained robust, the Dollar carry has begun to unravel as yields and yield differentials have continued to improve. Expectations of rate hikes by the Fed, along with weakness in the Europe have helped the Greenback to rebound and Gold to plummet heading into 2010.

10 KEY TECHNICAL EVENTS OF 2009 (in chronological order)

1. The USD/JPY fails at 87.05 on January 20th, marking a 4-week double bottom formation. Daily bullish diverging studies help buoy a recovery that lasts 10 weeks.

2. At 67% below it's 200-day MA, bullish diverging daily studies buoy the Dow Jones Industrial Average out of a short-term falling wedge on March 9th. The unprecedented recovery from the March lows has lasted nearly 9 months and continues to mark fresh year-to-date highs.

3. The EUR/USD convingly clears the 20-day MA on March 11th for the first time in 2009. The Dollar Index (DXY) closes below the 20-day MA to highlight a false-break pattern of the November 2008 high.

4. The USD/JPY clears the 200-day MA only days before, but on April 6th ends a 10-week recovery by rejecting near 101.60, a former key pivot support level. This would mark the USD/JPY's 2009 high.

5. On June 16th the EUR/USD rebounds off a key Fibonacci retracement at 1.3748 (38.2% of the entire range from the 2008 high to 2009 low) after same pivot formerly served as resistance. The EUR/USD respected the 50% and 61.8% retracement pivots in the ensuing months.

6. Gold breaks above a 4-week trendline on September 2nd, then breaches a 3-month trendline a few hours later. The following day, Gold breaks-out of a 16-month triangle pattern, ending months of consolidation. A month later Gold reaches a new all-time high.

7. The USD/JPY briefly probes below 85.00 before recovering on November 27th. The capitulation-type low marks a wide ranging white spinning top formation. The USD/JPY rallies off the 14-year low, recovering 8 Yen in the last 4 weeks.

8. The 2-year Treasury yield recovers from a steep decline, nearly reaching .60% on November 30th. The subsequent recovery highlights a possible a 11-month double bottom. Yields across the curve have enjoyed a spectacular run to end the year.

9. Gold hits another fresh record high above 1225 on December 3rd ahead of a bearish close. A daily spinning top formation at extraordinarily overbought levels on weekly and daily studies confirm Gold's blow-off top formation.

10. The EUR/USD breaks down out of a large 9-month rising wedge and a smaller 4-week rising wedge on December 4th to highlight a 10-day double top formation. A daily RSI triangle breakout and subsequent loss of 50-day MA support highlight a change in trend that has benefitted the DXY the last few weeks of the year.

(http://fxtrends2010.blogspot.com for 2010 posts)

Wednesday, December 23, 2009

Tuesday, December 8, 2009

12/08 - Dow Jones completes a symmetrical zig-zag

The Dow Jones Industrial Average has stalled near an equality target at 10495 (1.000x of 6470 to 8878 from 8087), suggesting the possible completion of a symmetrical zig-zag correction off 6470 (the March 2009 low). When comparing the first and last waves of the zig-zag, the latter part has taken 21 weeks to complete, compared to the initial wave's 14 weeks. This implies that the current rally is slowing down, which is characteristic of a weaker trend. Daily and weekly indicators are also deteriorating. The 9 &18-day moving averages are poised for a bearish cross. Daily bearish RSI and Stochastic divergence (23 November-04 December highs) and weekly bearish RSI divergence (21 September - 04 December highs) could induce a pullback that would highlight bear trendline resistance (connecting the 19 May 2008 and the 02/04 December highs). This would stage a retest of 10120 (21 Oct former high) ahead of a possible deeper correction towards 9999 (61.8% of 9679/10517). A sustained clearance of 10480 (bear trendline) negates the pullback scenario and suggests a possible extension towards 10561 (03 October 2008 intraday high).

Wednesday, November 18, 2009

11/18 - 9-period RSI triangle pattern should be watched

Both the DXY (US Dollar Index) and EUR/USD have formed triangle patterns within their respective 9-period daily RSI indicators. A break above RSI formation resistance & above 1-week trendline resistance at 1.4990 should reinvigorate EUR/USD bulls back towards the 1.5030-65 zone, above which exposes channel & wedge resistance at 1.5190. Below RSI formation support, however, coupled by a loss of the 50-day MA at 1.4808 (projected) would shift near-term expectations towards the bottom of a 3-month bull triangle at 1.4753. This would translate into an upside breach of the DXY's 20-day MA and would refocus the resistant 50-day MA now at 75.63.

Saturday, November 14, 2009

11/14 - Inflection point for risk appetite

With all the media focus attributing strength in the stock market to weakness in the US Dollar, I believe this correlation is being misrepresented and is often misunderstood. In fact, I believe the exact opposite, that the exuberance seen in equity prices (coupled with the record high price of Gold) is driving the DXY (Dollar Index) lower. It was the stock market (the financial stocks such as Lehman Brothers to be more specific) that initially created market panic and risk aversion world-wide. The Greenback was merely a bi-standard and rallied as a result of the reduction of risk-taking. Since March, however, it has been a different story, while stock markets and risk appetite have recovered, the Buck has reverted back to weakness. And since early September, the point when Gold broke-out of a long-term trend of consolidation, the DXY has continued it's persistent downtrend. While the fundamental outlook remains grim for dollar bulls, there are several "technical" signs that the current trend may be nearing an inflection point. In late February, I noted that there were signs that the on-going trend of dollar strength & equity weakness were showing signs of abating. I used factors such as the stock price in relation to their 200-day MA's, formation of topping & bottoming patterns in various markets and Elliot wave counts for the basis of my argument. It was only a few weeks later in March that the market began to turn. Well, I am seeing similar "technical" indications now, but of course in a different way. First off, Gold, which is now becoming extremely overbought according to weekly & daily charts, is now in the process of completing a "5 of a 5". This Elliot wave term means that Gold is nearing the completion of the fifth wave of a larger 5-wave move, suggesting that a substantial correction is possible. In addition to stock indices being almost 20% (18% to be exact) above their 200-day MA, volume has been characteristically weak and leadership of the financial stocks has shifted as of late. The Dow Jones Industrial Average is bumping up against bull channel resistance at a key juncture (10340 - a major 50% retracement). The S&P 500 has only marginally breached its October high and is in jeopardy of resembling a possible double top pattern. And the NASDAQ is possibly forming the right shoulder of a head & shoulders top. All 3 indices are demonstrating possible daily bearish RSI & MACD divergence. While, I am not inferring for one to sell their entire stock portfolio, I am simply insisting that the market is due for some sort of consolidation or correction, and that the backdrop maybe shifting beneficially for the US Dollar. One of my core recommendations include buying the USD/CAD when the so called "risk trade" has gone too far.

Wednesday, November 11, 2009

11/11 - EUR/USD probes above channel midpoint

Wednesday, November 4, 2009

11/04 - EUR/USD tests channel midpoint

The EUR/USD found support near the 50-day MA, forming the base of a 3-month bullish channel. The 40 level on RSI provided support once again, allowing a test of the bull channel's midpoint near the 1.49 handle. A failure here could provide an opportunity to retest the 50-day MA & channel support at 1.4655/85. Clearance suggests a retest of recent highs made in October.

Tuesday, October 27, 2009

Monday, October 26, 2009

Wednesday, October 21, 2009

10/21 - DXY rejects at key moving average

The US Dollar Index failed once again at the key 10-day MA. This allowed the EUR/USD to advance above the 1.50 threshold and now possibly sets the stage for further weakness in the Greenback. The absence of weekly divergence and lack of substantial resistance leave room for the EUR/USD to advance towards the 1.52 region, unless risk aversion reappears as it did in the final hour of North American trade Wednesday. Either way, the 10-day MA has become the proverbial line in the sand for the DXY & EUR/USD. All market participants should keep a careful eye on these key moving averages to determine whether a pullback could materialize into a more meaningful correction.

Tuesday, October 20, 2009

DXY maintains key support

The US Dollar Index maintains wedge trendline support and a key Fibonacci retracement (78.6% of July 08 to March 09 range) remains in place despite failing to overcome the 10-day MA & the 76 handle (former pivot support turned resistance). Meanwhile, the EUR/USD retreated after failing to breach the coveted 1.50 barrier, highlighting 4-hourly bearish MACD, RSI & Stochastics divergence. More importantly, Tuesday's reaction low has highlighted a short-term rising wedge, while 4-hourly RSI has formed a Head & Shoulders pattern. A break below wedge support & the 10-day MA (under the 1.49 region) together with a loss of RSI neckline support near 50, could suggest a deeper retreat towards the 35-day EMA (near 1.4750). A 4-hour close above 1.50, however, will negate the wedge scenario and could trigger a parabolic move up towards 1.52.

Monday, October 19, 2009

Friday, October 16, 2009

Thursday, October 15, 2009

10/15 - DXY maintains wedge support, key Fib

The US Dollar Index continues to maintain support at a wedge trendline and at a key Fibonacci retracement (78.6% of July 08 to March 09 range) just below 75.50. A strong close (for Friday) is now necessary to round-up daily RSI & MACD to confirm bullish divergence. The resistant 10-day MA will be the key test to determine whether the Greenback can recover. Failure to reclaim this fast, yet important moving average will likely leave the DXY susceptible to a capitulation-type sell-off. The EUR/USD is in a similar position. Recent strength is now probing a wedge trendline at similar resistance levels seen two years ago during the last bull campaign. Below rising 10-day MA support will confirm bearish divergence and signal a broader correction.

While it may be premature to buy the Greenback, bearish price-action in Gold and the Loonie are reasons alone for a possible reversal.

Tuesday, October 13, 2009

Friday, October 9, 2009

Thursday, October 8, 2009

10/08 - DXY probes key support near the 76 handle

The US Dollar Index retested key support just below the 76 handle. While this pivot managed to support once again, time is running out for the Greenback. A positive daily close is required for Friday to round-up daily MACD and complete bullish divergence. The next level of support is in the 76.50 region, where projected falling wedge trendline & a Fibonacci projection reside. The EUR/USD surpassed the 78.6% Fibonacci retracement at 1.4768, but failed to retest the yearly high. Beyond 1.4847 (2009 high) is 1.4914, where projected rising wedge resistance & a weekly pivot lie. Meanwhile, spot Gold continues to extend to record highs. While daily RSI is at extreme overbought conditions (80), there is no divergence yet. Thus, dips should be accumulated until daily studies display bearish divergence.

Tuesday, October 6, 2009

10/06 - DXY down as Gold surges to fresh record highs

Spot Gold broke-out of a 3-week triangle to begin the week, triggering Tuesday's fresh record high. The pattern break-out projects a move to the 1050 region, where extreme overbought RSI levels could delay further upside potential . In the meantime, oversold (hourly/4-hourly studies) dips below the previous record high (1033) should be accumulated. Meanwhile, the US Dollar Index, which rejected at the 35-day exponential moving average last week, fell below the 10-day MA. A retest of the 76 handle (September 2008 & 2009 pivot) is now more than likely, unless the DXY can somehow reclaim the 10-day MA (now at 76.70). The EUR/USD has rebounded from last week's oversold RSI base and has surged through the formerly resistant 10-day MA. A key Fibonacci retracement at 1.4768 (78.6% of latest downleg) is the only viable resistance level ahead of the yearly high at 1.4847. The reaction at 1.4847 or 76.00 DXY will be the critical factor in determining whether the Greenback is amidst a potential bottoming process or merely beginning another bear campaign.

Friday, October 2, 2009

Thursday, October 1, 2009

10/01 - Dollar set to test key moving average

The US Dollar Index benefitted on Thursday from renewed risk aversion. The commodity currencies suffered the most as the DXY managed to rebound off the 10-day MA. The EUR/USD rejected at its 10-day MA as well, hinting at a possible shift in trend. The next key technical event to watch will be whether the USD can clear the resistant 35-day exponential MA and if the EUR/USD can sustainably break below the 50-day MA (now at 1.4423). If these moving averages are breached, a broader correction should ensue. In the event of a reversal in risk appetite, clearing the 10-day MA (expected to be near 1.4630 at the time of the payrolls number) should reinvigorate dollar bears towards recent lows.

Tuesday, September 29, 2009

09/29 - Has the Pound found a bottom?

The British Pound rebounded on Tuesday after a suprise gain in the CBI survey. The UK currency was dragged down by the GBP/JPY on Monday, as the Yen initially surged on the back of Japan's Finance Minister's comments regarding currency intervention. The comments were eventually toned down and the Yen eased off its highs, allowing the Pound to rebound vs the Yen, as well as the Euro & Dollar. The GBP/USD, which found support near a key Fibonacci level(38.2% retracement of the March low to the 2009 high) was buoyed by a severly oversold daily RSI. The GBP/JPY also held up at key retracement (50% of the entire 2009 recovery). And after marking a fresh 24-year low on Tuesday, the beleagured GBP/AUD broke out of a bullish falling wedge to finish up 130 pips for the day. While the oversold nature of the Pound merits a temporary recovery, a retest of the recent lows may be required to build a formidable accumulation pattern. If a weak (slow-moving) counter-rally pauses at the 38.2, 50, 61.8 or 78.6% retracement level (from this week's recovery high to the swing low), a possible higher low could be in the cards. In the event of a marginal breach of this week's low, a possible double bottom pattern could be in store and the GBP should be accumulated. If, however, the current recovery begins to stall and is followed by an aggressive drive towards the low, caution is advised and suggests a broader correction is in place.

Monday, September 28, 2009

09/28 - Key moving averages to watch

The US Dollar Index & EUR/USD are trading between their 10 & 20-day moving average's. Look for new lows in the Greenback if the 10-day MA fails to support. If the EUR/USD breaks below it's 20-day MA, then look for a retest of the key 50-day MA. Meanwhile, commodities are not participating in the overall pick-up in risk appetite today and could be a hint that a broader correction is required before resuming strength.

The long USD/JPY position was stopped out overnight by comments made by the new Japanese Fin Min, who later realized his mistake and attempted to tone down his previous remarks.

Friday, September 25, 2009

Thursday, September 24, 2009

Wednesday, September 23, 2009

09/23 - EUR/USD & USD/CHF help reverse the risk trade

The US Dollar Index managed to claw back despite making a fresh 52-week low. The false-break of the September 2008 low (75.89) triggered a reversal that could possibly mark a short-term double bottom base. A sustainable rebound above the 77 handle would confirm the accumulation pattern and refocus the 78 region, where a previous Fibonacci retracement lies (61.8% of 70.70-89.62). The EUR/USD & USD/CHF made an intraday double top & bottom (respectively) just after the FOMC announcement. This helped to complete the reversal in the so-called risk trade that was initiated by the turn-around in Treasury yields & Crude oil. Moreover, 4-hourly bearish MACD divergence has allowed the EUR/USD to stall near a 50% extension target at 1.4830. While, the overall outlook for risk appetite continues to be optimistic, Wednesday's price action suggests that the trend may be temporarily exhausted. This would be a positive development for the Greenback, which is already overwhelming net-short by large speculators (according to recent CFTC IMM data). As a result, the EUR/USD could quickly retest 1.4618 again (Fibonacci retracement). Meanwhile, reclaiming 1.4830/45 will immediately expose 1.4867 (September 2008 high).

Tuesday, September 22, 2009

09/22 - EUR/USD rebounds off key Fibonacci pivot

The EUR/USD reached a fresh 52-week high after rebounding Monday off a key Fibonacci retracement at 1.4618 (61.8% of the 2008 high to the 2009 low). The US Dollar Index, which failed to clear the 10-day MA has fallen back to the September 2008 pivot located near the 76 handle. While daily studies remain at oversold levels, momentum is clearly against the Greenback. A close below 75.89 (September 2008 swing low) immediately exposes 74.75, where a Fibonacci retracement (78.6% of 70.70 - 89.62) and weekly pivot (Q4 2007/Q1 2008 low) reside. Meanwhile, the EUR/USD's bullish structure remains firmly intact while above the upward sloping 50-day MA and will attempt to clear 1.4867 (September 2008 swing high) on it's way towards the 1.50 region.

Wednesday, September 16, 2009

09/16 - EUR/USD probes December swing high

The EUR/USD has extended strength through the key (61.8%) Fibonacci retracement near 1.46 to probe the December swing high at 1.4722. This pivot is also a 1.236% extension of the 50% & 61.8% retracement levels of the 2008 high-2009 low range. Daily RSI is at severly overbought levels and is above 77 (9-period) for only the fifth time in two years. Meanwhile, the DXY (US Dollar Index) is now 7.5% below its 200-day moving average, the most since carving out a bottom 17 months ago. A sustainable move above 1.4722 will next expose the September swing high at 1.4867. Beyond this pivot, however, there lacks any substantial resistance until the 1.53 region, indicating the potential for a fast market or exhaustive-type move. Although, the EUR/USD's bullish structure remains intact (while above the upward sloping 50-day MA), a pullback is anticipated back towards the key Fibonacci retracement at 1.4618.

Wednesday, September 9, 2009

09/09 - EUR/USD tests key Fibonacci retracement

The US Dollar dropped to fresh 11-month lows as Gold crossed above the key psychological 1000 threshold on Tuesday. The DXY lost key trendline support as the EUR/USD broke above trendline resistance and the formerly resistant June swing pivot high at 1.4338. The subsequent dollar weakness has led to a test of a key Fibonacci retracement near 1.46 (61.8% of the 2008 highs to the 2009 lows). This key pivot should provide decent resistance as the other key retracement levels (38.2% & 50%) were previously respected by the market. Moreover, the DXY remains comfortably within a large falling wedge which tend to be bullish and while Gold continues to struggle with the 1000 level, the dollar should be able to withstand the current bout of weakness.

Thursday, September 3, 2009

09/03 - DXY remains supported by key trendline

The US Dollar Index probed out of a 6-month downward sloping trendline, but failed to follow-through by rejecting at the stubborn 35-day exponential moving average. Ensuing weakness was contained, however, by corrective trendline support originating from the early August lows. Meanwhile, the EUR/USD, which managed to pare overnight losses, rejected once again at the June swing pivot at 1.4338. If these two pivots, DXY trendline support (now at 78.00) & EUR/USD's June swing high, manage to contain expected volatility from Friday's jobs report on a closing basis, then the Greenback should recover through the 35-day EMA towards the psychological 80 handle. This would allow the EUR/USD to break below the supportive 50-day MA towards the August low at 1.4046. An eye should be kept on US Treasury Yields and USD/JPY, as both are severly oversold. A solid US employment report could trigger a rebound in yields and allow the USDJPY to rally back towards the mid-90's.

Our second attempt to capitalize on a recovering Greenback was foiled once again. Generally speaking, stop-losses are trailed to cost once the position has gained nearly 50 pips. Another sell position has been added, this time at the June pivot.

Wednesday, September 2, 2009

09/02 - Chart of the week

To avoid a conflict of interest, I am unable to post during work hours. I trailed the short position to cost earlier in the day on the EUR/USD's failure to break below 1.4194 and was stopped at cost. I have reinitiated a short position with a stop-loss above the June swing pivot.

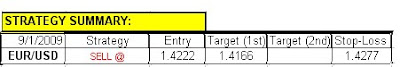

Tuesday, September 1, 2009

09/01 - DXY breaks out of a 6-month downtrend

The US Dollar Index managed to bottom out near the key Fib at 77.93 (61.8% of 70.69-89.62). The failure of capital markets to capitilize on the better than expected manufacturing numbers triggered a reversal that helped buoy the Greenback through a 6-month trendline at 78.66. The EUR/USD's failure to overcome the 60 level on daily RSI hinted of weakness that could now potentially break below the supportive 50-day MA (now at 1.4160). Meanwhile, the major US equity indices have finally sustained a correction of more than just 2 days, breaking the string of couter-trend rejections seen since the July low. This suggest a broader correction is in store and could be the tailwind that guides the DXY back towards the psychological 80 handle. If, however, the EUR/USD 's 50-day MA and 40 level (daily RSI) are maintained on a closing basis, then market bulls could reassert for a move back towards 1.4338 (June's swing pivot).

Friday, August 21, 2009

08/21 - DXY probes key Fib

The US Dollar Index rejected at a 5-month downward sloping trendline and at the key 50-day moving average earlier in the week and has struggled going into Friday's close. A strong rebound in commodities and equities has forced the DXY back towards a key Fib at 77.93 (61.8% of 70.69-89.62). While 4-hourly studies are at oversold levels, daily indicators suggest plenty of room to test 77.45, near the December 2008 swing low and the recent lows made in early August. Moreover, according to seasonal charts the Greenback historically fares poorly after mid-August into the second half of the year. The EUR/USD rebounded from oversold RSI levels after briefly probing below the 50-day MA. The sustained clearance of the June pivot at 1.4327 should expose the recent high at 1.4448 ahead of a possible extension towards 1.4600.

The major US equity indices failed to retreat further than 2 days once again. As a result, previous resistance was wiped out. The trend is clearly intact until the major averages can sustain a counter-trend correction beyond 2 days. The next upside target for the S&P 500 resides in the 1048 region, where an important Fibonacci extension and pivot coincide.

Friday, August 14, 2009

08/14 - Chart of the week

The three major US equity indices have all stalled at key technical levels. The S&P 500 has paused at 1013.94, the 38.2% retracement of the 2007 & 2009 range. The DJIA has paused at the same retracement level (at 9424.70). The Nasdaq has completed a double bottom measured move near 2010 and has consolidated just below it over the past few sessions. While it may be premature to call a top, a correction is in store as these key resistance levels remain intact. The counter-rallies have been brief, mostly limited to 2 down days before finding a higher level of support. Thus, one way to gauge market strength will be to see whether Friday's retreat can extend through Tuesday, more than just a 2-day correction. If equities manage to rebound, however, there is a substantial probability that these equity indices will race to new highs.

Thursday, August 13, 2009

08/13 - EUR/USD's symmetrical exhibition

The EUR/USD continues to respect 1.4227, the 50% retracement level of the 2008 highs & 2009 lows. Two weeks ago, the pair retraced 50% below this level, then 50% above the following week. Wednesday's rebound coincided with a 23.6% retracement below the 1.4227 pivot and Thursday's high rejected near 1.4312, 23.6% retracement above 1.4227. The symmetry exhibited suggests that despite last week's brief breakout, the EUR/USD should retest the region below 1.4227 relatively soon. Meanwhile, the DXY is probing the June pivot low of 78.31 since putting in a 3-day double top. A higher base is sought to take out the resistant 35-day exponential moving average.

Tuesday, August 11, 2009

08/11 - The big picture

The US Dollar Index is consolidating near the 78.6% retracement of the latest downleg, a key last stop ahead a probable full retracement. The DXY is probing the 35-day exponential moving average after a succesful defense of 78.20, a 61.8% retracement. Above the 50-day MA is the 50% retracement at 80.40, while below 78.79 (61.8% of 77.42-79.64) will delay the current recovery for the 10-day MA at 78.51.

The EUR/USD is consolidating above the 50-day MA since rejecting at the 50% pivot retracement at 1.4217. This bearish rejection and the emergence of a possible weekly RSI double top hint of further weakness despite oversold 4-hourly studies and daily RSI. If the single currency maintains 1.4073 (50-day MA) , however, then the medium-term bullish structure remains intact.

Monday, August 10, 2009

08/10 - GBP/USD tests the 50-day MA

The US Dollar Index has continued to rally after marking a short-term double bottom last week. The disconnect with the tight correlation between risk appetite and dollar weakness has put an emphasis on the importance of interest rate differentials. The BOE's announcement to increase quantitative easing followed by a stronger-than-expected non-farm payrolls report has enabled the the interest rate differential between 10-year (UK ) Gilts and 10-year (US) Treasuries to shrink from a 32 basis point advantage to a +11 differential. The GBP/USD's weakness highlights bearish MACD divergence and has triggered the latest probe of the key 50-day moving average. A sustained loss of 1.6430 (50-day MA) exposes the 1.6000 region and will signal a medium-term shift in trend. Meanwhile, the DXY and EUR/USD are approaching their 50-day MA's and should be tested if the Cable continues to retreat.

Friday, August 7, 2009

Subscribe to:

Comments (Atom)