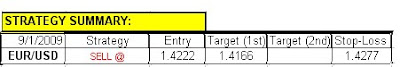

The US Dollar Index managed to bottom out near the key Fib at 77.93 (61.8% of 70.69-89.62). The failure of capital markets to capitilize on the better than expected manufacturing numbers triggered a reversal that helped buoy the Greenback through a 6-month trendline at 78.66. The EUR/USD's failure to overcome the 60 level on daily RSI hinted of weakness that could now potentially break below the supportive 50-day MA (now at 1.4160). Meanwhile, the major US equity indices have finally sustained a correction of more than just 2 days, breaking the string of couter-trend rejections seen since the July low. This suggest a broader correction is in store and could be the tailwind that guides the DXY back towards the psychological 80 handle. If, however, the EUR/USD 's 50-day MA and 40 level (daily RSI) are maintained on a closing basis, then market bulls could reassert for a move back towards 1.4338 (June's swing pivot).