Friday, July 31, 2009

Thursday, July 30, 2009

07/30 - EUR/USD's possible bearish rejection

The EUR/USD has stabilized after rebounding off 1.40, near the midpoint of the latest 1.38-1.42 range and a key fibonacci retracement (61.8% of 1.3839-1.4300). The possible bearish rejection off former trendline support hints of a weakness towards 1.3957 initially (78.6% of 1.3839-1.4300). If the 50-day MA (1.4033) remains supportive, then the medium-term bullish structure remains intact.

The US Dollar Index looks like it may have rebounded off an internal trendline as well, but remains constricted by the 20-day MA and a key fibonacci retracement (38.2% of 78.31-81.50). Another intraday higher low would suggest a retest of the 80 handle, where the 50-day MA and 50% retracement coincide. A sustained loss of 79.18 (key pivot) dampens the recovery outlook.

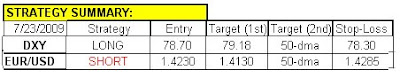

DXY's stop-loss has been raised and a new EUR/USD short position has been added.

Wednesday, July 29, 2009

07/29 - DXY continues recovery, eyes 80 handle next

The US Dollar Index continues to recover after completing the first intraday higher low in nearly 3 weeks. Buoyed by 4-hourly & daily bullish MACD divergence, the DXY's rally broke through the key 79.12 pivot and 3-month trendline resistance to probe the 20-day MA. A fresh higher low is now sought ideally by the 79.12 pivot for a test of the targeted 50-day moving average. This also coincides with a 50% retracement level located near the psychological 80 handle, clearing which further validates the possible double bottom base that is currently being formed. Meanwhile, the EUR/USD broke below 3-month trendline support and is currently probing the 50-day MA at 1.4033. A sustained loss of the 50-day MA suggests weakness towards the 1.38 handle.

The stop-loss has been trailed to cost.

Tuesday, July 28, 2009

07/28 - DXY rebounds after reaching new 2009 low

The US Dollar Index rebounded after marginally breaking below the previous 2009 low. The subsequent false-break recovery was buoyed by 4-hourly bullish MACD divergence and managed to break 4-hourly & daily RSI resistance. Closing above the 4-hour mid-Bollinger band marks the second time in the past week and is considered as constructive price-action. A higher low within the upper half (of the Bollinger bands) would signal dollar strength towards the 50-day moving average near the psychological 80 handle. Meanwhile, last week's EUR/USD weekly breakout has lacked follow-through and will be viewed as an outlier if the pair trades below 1.4064, where a cluster of key moving averages and a fibonacci range vibration reside. This region would need to be cleanly lost to dent the medium-bullish structure.

Monday, July 27, 2009

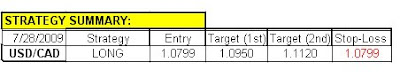

07/27 - LONG USD/CAD position initiated

Friday, July 24, 2009

07/24 - CHART OF THE WEEK

The Dow Jones Industrial has paused at the January high of 9088 and is at extremely overbought levels according to a daily RSI study. Bearish MACD divergence suggests a possible correction back towards the June swing high. The Nasdaq composite and S&P 500 are in similar technical situations and are probing key fibonacci extension levels. Other metrics of risk appetite such as the CRB index and Gold have both stalled at key fibonacci retracement levels. After such an impressive run look for equities to consolidate next week.

Thursday, July 23, 2009

Wednesday, July 22, 2009

07/22 - USD double bottom?

The US Dollar Index has suffered due to renewed strength in risk appetite. The rejection below 79.18 (key fibonacci retracement) and the inability to clear a 4-hourly mid-Bollinger band have kept the bearish structure intact. The follow-through, however, has been limited. In fact, subsequent price-action is threatening to form a 2-day double bottom and if confirmed could strengthen the case for building a larger (6-week) double bottom base. Moreover, several charts indicate that risk appetite may be exhausting the recent run-up, which would help to alleviate pressure on the Greenback. The EUR/USD rebounded off its recent range high at 1.4160/70 for the second time in as many days, a third test carries a strong probability of a significant break to the downside. If the EUR/USD fails to breach 1.4160 (and the DXY fails to reclaim 79.18), then a retest of the June high becomes increasingly likely.

Tuesday, July 21, 2009

07/21 - Loonie rebounds off key fibonacci retracement

The USD/CAD briefly flirted with a key fibonacci retracement at 1.0987 before rebounding. As the BOC took centerstage, 4-hour bullish MACD divergence allowed the Loonie to break above RSI trendline resistance to possibly hint of a short-term base. This triggered a bounce in the US Dollar Index and allowed the EUR/USD to fall below 4-hourly RSI trendline support. Only a loss of broken trendline support near 1.4140 will further delay strength to possibly refocus the 50-day MA.

Monday, July 20, 2009

07/20 - EUR/USD threatens to breakout of range

The EUR/USD has probed above the recent 1.3730 -1.4170 range after breaking above trendline resistance. A weekly close above 1.4170 would be a first since September and suggests an end of rangebound trade that has persisted over the past few months. While the 50-day moving average and weekly RSI's are maintained, the immediate target is the 2009 high at 1.4335. The next target comes in near 1.46, close to the spike high in December and a key fibonacci retracement. Meanwhile, a loss of 4-hourly RSI trendline support is required to delay strength and refocus the 1.4140 zone, where the recently broken trendline now resides.

While equities, commodities and foreign currencies continue to surge on improving risk appetite, treasury yields are telling a different story. In general, interest rates tend to turn or reverse ahead of stocks and commodities. After an initial surge, treasury yields retreated quite significantly Monday on the back of diverging 4-hour studies. As bearish divergence is also setting up on 4-hourly charts of various indices and currencies, it is yet to be seen whether they will follow interest rates lower as well.

Friday, July 17, 2009

07/17 - CHART OF THE WEEK

The Nasdaq has soared to a new 2009 high, but is stalling with RSI in overbought territory. A false-break scenario is possibly setting up with a marginal breach of the former high registered in June. If MACD rolls-over it will mark bearish divergence and could coerce the index back below the 1865 mark, where a key fibonacci retracement lies (38.2% of the 2009 low to the 2007 high). If 1865 is maintained, however, the next key target is 2050 (50% retracement & double bottom measured objective.

The EUR/USD short position was trailed to cost in the North American session, but has been stopped out. The DXY position is still in play and it's stop-loss has been trailed to cost.

Thursday, July 16, 2009

07/16 - EUR/USD rejects at the top end of it's range

The EUR/USD rejected at the top end of the latest range after probing above trendline resistance. A weekly close above 1.4170 and a daily close above 1.42 suggests a bullish extension that would target 1.46, the next fibonacci retracement zone. Although, both daily & weekly RSI's suggests further strength ahead, the failure at 1.4170 and the inability to substantially clear 1.4130 (trendline) indicate that the near-term trend may be exhausting. Moreover, 4-hour bearish MACD divergence could coerce the EUR/USD back towards the middle of the recent range. Meanwhile, the USD/CAD has stalled at 1.1143 (key fibonacci retracement) and Gold has paused at the 50-day MA. If the US Dollar Index can maintain support at 79.18 (78.6% retracement) then it is likely to retest the 80 region again.

07/16 - SELL EUR/USD (BUY DXY)

Sell EUR/USD on a false-break of trendline resistance and 4-hourly bearish MACD divergence. The DXY has maintained support at a 78.6% fibonacci retracement at 79.18. The USD/CAD has stalled at 1.1143 (key fibonacci retracement) and Gold has paused at the 50-day MA. Overall, risk appetite looks exhausted at the moment.

Wednesday, July 15, 2009

07/15 - DXY breaks below consolidative support

The US Dollar Index has lost corrective support on the back of renewed strength in risk appetite. The EUR/USD is now probing the upper half of it's recent range since rebounding off the 50-day MA on Tuesday, but has stalled at 10-week trendline resistance. A sustained clearance of 1.4130 (current location of trendline) will quickly propell the EUR/USD towards the 2009 high established on June 3rd. Moreover, daily RSI has formed a double bottom base in the 40 region, which is characteristic of a bull market. If the Greenback maintains the 79.02 level (78.6% retracement) and the EUR/USD fails to clear trendline resistance, then focus will shift back to the 50-day MA.

Tuesday, July 14, 2009

07/14 - Loonie & Gold rebound

Monday's short-covering equity reversal enabled key indicators of risk appetite such as the Canadian Dollar and Gold to rebound. Daily bullish MACD divergence helped Gold to test 6-week trendline resistance and daily bearish MACD divergence coerced the USD/CAD to probe a key fibonacci retracement at 1.1366. While moves in the Loonie (USD/CAD) and Gold are classified as corrective so far, a sustainable recovery could influence the EUR/USD & DXY (US Dollar Index) to breakout of rangebound trade. A loss of consolidation support at 79.815 would allow the Greenback to venture back towards the 2009 low at 78.334. If, however, the EUR/USD loses 50-day MA support, then there is a high probability of retesting 1.3730-1.3839, the lower end of the latest range.

Monday, July 13, 2009

07/13 - Risk rebounds as FX remains rangebound

The US Dollar Index continues to trade within a sideways triangle (consolidation) formation while risk aversion has seemingly abated. The recovery in risk appetite should be viewed as an overdue technical correction as opposed to a fundamental shift in investor sentiment. The inability to extend weakness caused a short-covering reversal, enabling several indices to form a short-term double bottom. Daily bullish MACD divergence and oversold RSI allowed Gold to recover, highlighting support at a key fibonacci level at 912.27 (61.8% of 864 to 990). The USD/CAD failed to clear a key fibonacci retrace at 1.1655 (38.2% of 1.0782-1.3068) and fell below corrective trendline support as a result. Meanwhile, the EUR/USD and the rest of the currency market remain comfortably rangebound and will continue to eye developments in equity and commodity markets .

Friday, July 10, 2009

Thursday, July 9, 2009

07/09 - EUR/USD rebounds off the 50-day MA

The US Dollar Index failed yet again at trendline resistance, near the 50-day MA. Wednesday's rejection highlights the inability of the Greenback to sustain a rally for more than four trading days. However, while the key fibonacci retracement at 79.47 (61.8% of 78.37-81.46) remains intact, there is a high probablility that 80.75 (current location of trendline & 50-day MA) will be breached.

The EUR/USD remains mired within a tight range between two key retracement pivots (1.3730 & 1.4170). 4-hour bullish MACD triggered a rebound off 1.3839, where the 50-day MA and a fibonacci retracement reside (78.6% of 1.3730-1.4170). The medium-term bullish structure remains intact while price-action and weekly RSI remain above 1.3730 and 52, respectively.

There are several reasons why crude oil (CLQ9) is due for a period of consolidation after such a relentless sell-off. First, it has completed a double top measured move (measured from the neckline). Second, it has paused at a key fibonacci retracement (61.8% of 50.50-73.67). And lastly, 4-hour studies are oversold and bullish divergence MACD indicate possible exhaustion.

Wednesday, July 8, 2009

07/08 - Yen prevents DXY from breaking trendline

The US Dollar Index continues to probe a 4-week trendline at 80.86. While the Greenback traded higher against most currencies on Wednesday, the main reason it has not breached key resistance is due to Yen strength. Increased risk aversion, highlighted by equity weakness (specifically the confirmation of distribution patterns) has allowed the Yen to flourish in this enviroment. Meanwhile, the EUR/USD has retreated below the 35-day EMA & 23.6% retracement zone at 1.3907, but has paused at 1.3839. This pivot point coincides with a fibonacci retracement of the latest range (78.6% of 1.3737/1.4170) and the 50-day MA. The clearance of 1.3839 and 80.86 immediately exposes 1.3724/83 (EUR/USD's former swing high/38.2% retracement level) and 82.68 (DXY's 38.2% retracement) .

Tuesday, July 7, 2009

07/07 - EUR/USD fails at former trendline

As risk aversion rears it's ugly head, the US Dollar Index continues to benefit. Although, foreign exchange markets remain mired within relatively tight ranges, energy markets have pulled back quite significantly. The reversal in risk appetite has enabled several equity indices to probe below their head & shoulder necklines, reaffirming a medium-term top in the stock market. Meanwhile, the EUR/USD reversed course at former trendline support, highlighting a bearish rejection and a possible shift in sentiment. Dollar bulls will now look to clear 80.75/86, where 4-week trendline resistance and the 35-day EMA lie (also correlates to the EUR/USD's 35-day EMA & 23.6% retracement level near 1.39). Clearing these key pivots will suggest that the Greenback has temporarily bottomed and initially targets 82.68 (38.2% retracement) and 1.3724/83 (EUR/USD's former swing high/38.2% retracement level).

[STRATEGY] BUY DXY (SELL EUR/USD)

Monday, July 6, 2009

07/06 - EUR/USD & DXY break key trendlines

The US Dollar Index has remained fairly strong on the back of last week's worse than expected jobs report. The reemergence of risk aversion has allowed key fibonacci retracement levels (DXY's 61.8% of 78.31-81.35 & EUR/USD's 78.6% of 1.4326-1.3745) to remain intact and has triggered a breach of 10-week trendlines (both DXY & EUR/USD) . The follow-through, however, has been very limited and the 23.6% retracement levels and 35-day EMA's have proven to be significant obstacles. More importantly, the EUR/USD remains entrenched in between two major retracement levels at 1.3737/1.4170 (38.2% & 50% of the entire 2008 range) and is entering a period where volume tends to dry up. In the meantime, the currency markets will take their cue from equity markets (such as the DJIA and S&P 500), which are testing their head & shoulder necklines.

Thursday, July 2, 2009

Wednesday, July 1, 2009

Subscribe to:

Comments (Atom)