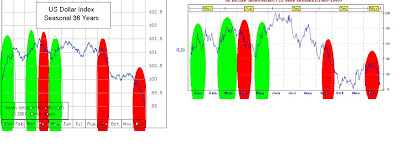

The month of April has historically been unkind to the US Dollar Index. Over the past seven years, the Greenback has seen gains in April only twice, both times were supported by either Fed tightening, hawkish rate expectations or both. Both seasonal charts shows that on average, the dollar tends to fall throughout the month then bottom out in early May. April also tends to be one of the strongest seasonal months for the DJIA and S&P, both of which have had strong inverse correlations with the US Dollar Index. These seasonal factors alone suggest that a sustained loss of 84.30 (former consolidative resistance) will enable the dollar to test the key 200-day MA.

STRATEGY: SELL USD's