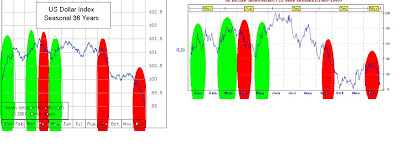

The US Dollar Index has rebounded after failing to sustain losses below the 84.30 pivot and highlights on-going support via the 160-day MA. This has enabled a push above the mid-level threshold of MACD and a downward sloping RSI trend line. This zig-zag formation has found support from the former resistant 20-day MA, but will have to clear the bull-bear 50% retracement zone at the 86 handle to further defy bearish seasonal forces. A sustained loss of the 100-day MA should re-open key 160-day MA support then the 200-day MA.

{STRATEGY} LOOK TO SELL (BUY EUR/USD)